All eyes on the Fed: Divided views, steady policy

Today, markets are laser-focused on the outcome of the Federal Reserve’s two-day policy meeting, which concludes later in the day. Despite growing speculation about potential interest rate cuts later this year, the consensus remains that the Federal Open Market Committee (FOMC) will keep the federal funds rate unchanged in the 4.25%–4.50% range. This would mark the fifth consecutive hold.

However, this is far from a routine meeting. Markets are parsing every word from the Fed with heightened sensitivity as policymakers navigate a complex economic landscape marked by mixed inflation signals, evolving trade dynamics, and political pressure. The tone and phrasing of today’s policy statement and Powell’s press conference will be closely scrutinized for clues about the Fed’s next steps, particularly heading into the September meeting.

Key themes and expectations:

A divided committee, but policy on hold (for now)

The FOMC remains internally divided. Some members, notably Governors Chris Waller and Michelle Bowman, have expressed support for an immediate rate cut. However, a clear majority is expected to vote in favor of maintaining current policy. If Waller and Bowman do dissent, it would mark the first time two board governors dissent on the same decision since 1993 — a rare but notable event.

This internal split reflects contrasting interpretations of recent data: while some see slowing job growth and moderating inflation as justification for easing, others remain concerned that inflation is still too sticky to justify rate cuts.

Inflation signals and data sensitivity:

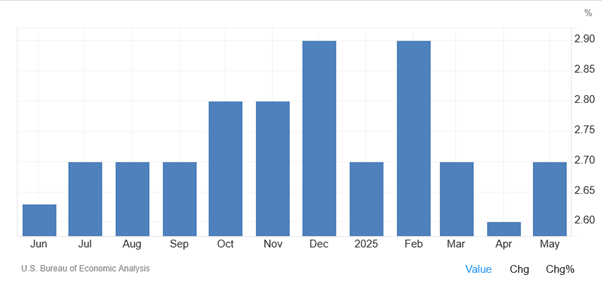

Inflation continues to be the central issue. Core PCE data — due tomorrow — is expected to be firm, adding weight to the Fed’s cautious stance. Similarly, July’s jobs report, due Friday, is anticipated to show strength in labor markets, which may reduce the urgency for immediate easing.

Despite some early effects of tariffs feeding into imported goods prices (notably clothing, furniture, and electronics), inflation in less-exposed categories remains subdued. Some officials are wary of broader inflation spillovers, while others see limited long-term impact from tariffs. This nuanced view reinforces the Fed’s “wait-and-see” mode.

What to watch in the statement:

The FOMC statement’s language will offer critical insights. Unless there is a major shift in tone, we expect the Fed to:

Maintain the description of the labor market as “solid” — any softening here would be a dovish signal.

Continue referencing “solid” economic growth, supported by strong Q2 GDP figures (forecasted at 2.9%), largely due to net exports.

Possibly acknowledge reduced uncertainty following legislative and trade developments, which would be interpreted as hawkish.

A more dovish shift would involve subtle edits like describing growth as having “moderated” or stating that labor conditions have “generally eased.” However, such language changes are not expected at this stage.

Powell’s press conference: The main event

Chair Powell is anticipated to reiterate that the Fed is in no rush to cut rates, emphasizing data dependency. However, he may guide markets toward key data releases in August and September — especially the next two CPI reports — as potential catalysts for a policy shift at the September meeting.

While Powell is unlikely to explicitly signal a cut today, any mention of cooling job gains or trade-related risks could be viewed as preparing the ground for a pivot in the fall.

Political pressures and independence

President Trump’s continued calls for rate cuts — and even his recent direct engagement with Powell — have added political pressure. Yet, the Fed is expected to maintain a stance of independence, avoiding any action that could appear to compromise its credibility.

That said, a scenario where the Fed eventually cuts in September despite firm inflation data could be interpreted by some as political appeasement. Market reaction to such a shift would depend heavily on how Powell frames the decision.

Market implications:

Equities: Investors are positioned cautiously, with moderate gains in anticipation of a dovish signal. A neutral-to-hawkish outcome may trigger short-term volatility.

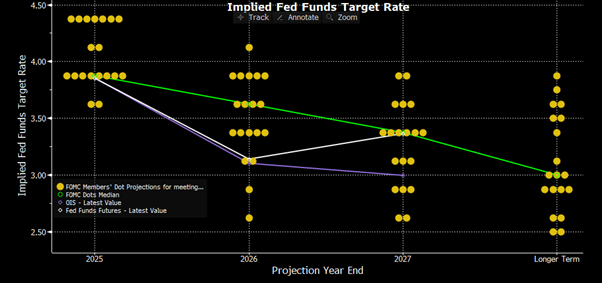

Bonds: The front end of the yield curve remains sensitive to any policy hints. Fed funds futures currently price in roughly a 66% probability of a 25-bps cut in September.

Dollar: The USD remains bid as expectations of imminent easing have faded slightly. A hawkish Powell could provide further strength.

The Fed is walking a tightrope between encouraging economic resilience and persistent inflation risks. Today’s decision will likely maintain the status quo, but with a focus on how the Fed characterizes economic conditions and frames its forward guidance. Any signs of internal dissent, nuanced shifts in language, or data-driven roadmaps for potential easing will set the tone for markets in the weeks ahead.

We remain vigilant as pivotal economic data unfolds later this week, which will help shape expectations going into the September FOMC meeting. Stay tuned.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.