Markets on edge ahead of earnings and tariff deadline

Markets on edge ahead of earnings and tariff deadline

Global financial markets are treading cautiously at the start of this week. As investors brace for key corporate earnings and looming trade deadlines, sentiment is tempered by rising geopolitical and economic uncertainty. From muted equity movements to escalating fiscal pressures in the UK, the outlook remains clouded by macro headwinds and policy divergence across major economies.

Global equities: Rangebound as earnings season picks up

European stocks edged lower and US futures hovered near all-time highs. The Stoxx Europe 600 dipped by 0.2%, while futures on the S&P 500 and Nasdaq 100 were largely unchanged following recent record closes. Japanese equities fell, weighed by political jitters after Prime Minister Ishiba’s coalition lost ground in the latest elections.

With valuations already elevated, S&P 500 trades around 22x forward earnings, the focus is squarely on upcoming earnings from key megacap firms including Tesla and Alphabet. Any disappointment could trigger heightened volatility as investors reassess risk appetite in light of persistent tariff concerns.

Trade and tariff countdown: Tensions heating up

Uncertainty is intensifying ahead of the August 1 deadline for new US-imposed tariffs. While some speculate President Trump may de-escalate, additional unilateral tariff announcements are still possible. The Philippines’ President is set to meet Trump in Washington today in hopes of reaching a last-minute trade deal, while talks with India are expected later in August.

Trade tensions remain a significant overhang, especially for multinational corporations navigating disrupted supply chains and increased cost structures.

UK fiscal update: Borrowing overshoots expectations

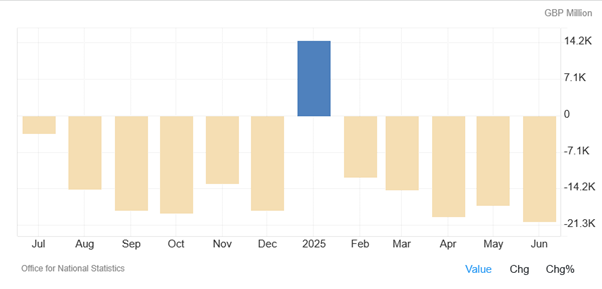

UK government borrowing in June surged to £20.7 billion, significantly exceeding the consensus forecast of £17.5 billion. Debt-servicing costs jumped due to inflation-linked bonds, with June interest payments alone reaching £16.4 billion—the third-highest on record.

This fiscal strain has placed Chancellor Rachel Reeves in a politically precarious position. With spending pressures mounting and prior U-turns on welfare cuts still fresh, speculation is growing around potential tax increases in the autumn budget. Gilts sold off on the data, pushing the 10-year yield up to 4.63%.

The public sector net debt now stands at 96.3% of GDP, its highest level in decades, amplifying scrutiny of the government’s fiscal credibility.

Central bank developments: Political pressure and policy shifts

In the US, Federal Reserve Chair Jerome Powell continues to face criticism from the administration. Treasury Secretary Scott Bessent has publicly called for a review of the Fed’s non-monetary activities—particularly the renovation of its headquarters—citing “mission creep.” This adds a political dimension to the Fed’s operational autonomy and could stir further uncertainty around its future direction.

In the UK, the Bank of England is reportedly reconsidering its plans to roll out a digital pound for everyday use, reflecting broader skepticism toward central bank digital currencies (CBDCs).

Currency, commodities and crypto: Mild volatility across assets

Currencies:

The US dollar rose modestly, with the Bloomberg Dollar Spot Index up 0.1%. The euro held steady at $1.1690, while the Japanese yen weakened by 0.4% to 147.92 per dollar. The British pound fell 0.2% to $1.3470.

Commodities:

Oil declined for the third consecutive session, with Brent crude trading at $68.95 per barrel. Gold also slipped 0.3% to $3,385.47 an ounce. Iron ore climbed on expectations of Chinese steel reforms and infrastructure investment.

Cryptocurrencies:

Bitcoin rose 0.8% to $117,901, while Ether retreated 1.7% to $3,695. These moves reflect the ongoing speculative interest in crypto despite broader macro uncertainty.

Corporate highlights: Strategic shifts amid policy headwinds

- AstraZeneca announced plans to invest $50 billion in the US by 2030, likely a strategic hedge against looming tariffs on imported pharmaceuticals.

- Sanofi is acquiring Vicebio for $1.15 billion in upfront payments, expanding its biotech pipeline.

- Sarepta Therapeutics halted shipments of its gene therapy product amid regulatory concerns.

- Oracle is reportedly in talks to secure a $100 million annual cloud deal with Skydance.

Key themes to watch

Markets are clearly in a holding pattern—pulled between strong earnings momentum and an uncertain macro-policy backdrop. Trade talks, central bank posturing, and rising fiscal constraints across developed economies will remain key drivers. Earnings results this week will test the resilience of market optimism.

Prepared by Nour Hammoury, Chief Market Strategist at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.